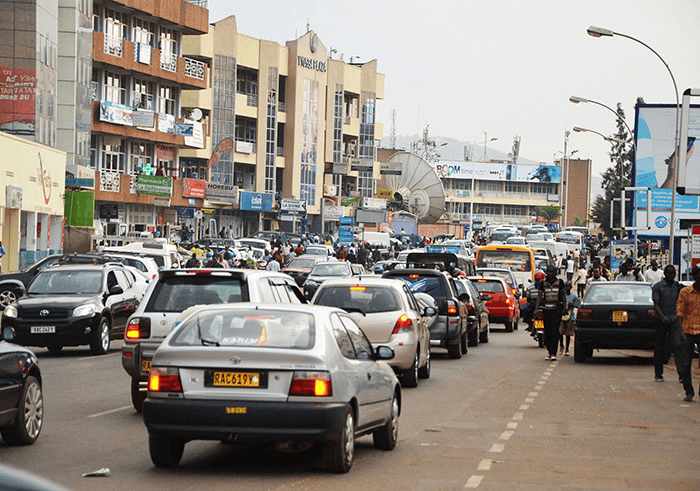

The Motor Vehicle Road Levy must be declared and paid by 31 December 2025. With the updated RRA e-services and USSD options, vehicle owners now have simplified pathways.

09.12.25 03:45 PM

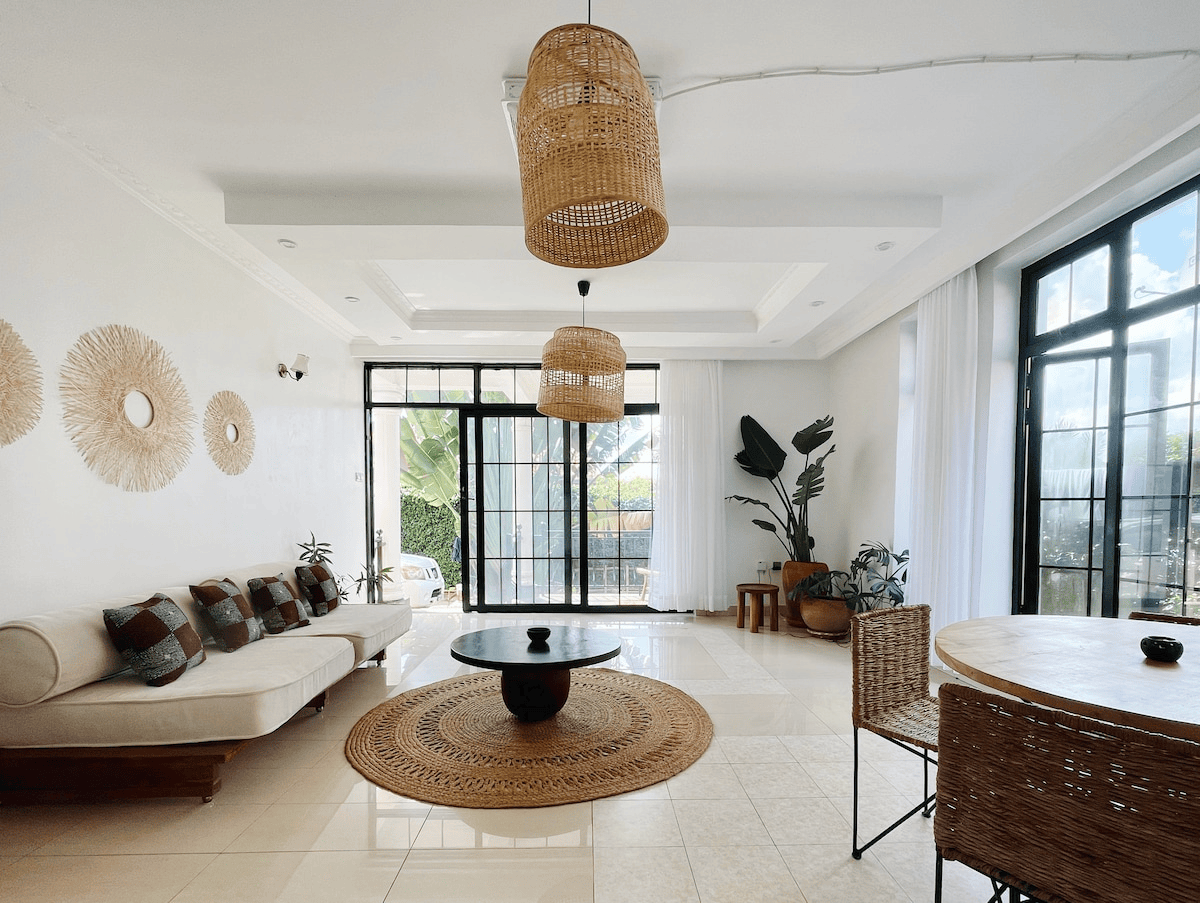

The Government of Rwanda introduced a 3% Tourism Tax on accommodation through Law nº 015/2025, effective May 29, 2025. If you run a hotel, guesthouse, lodge, or short-term rental (like Airbnb), you are now legally required to register and file this tax monthly via the RRA (Rwanda Revenue Authority...

ALSM Ltd (formerly ALCPA) is a premier accounting, audit, tax and business advisory firm in Rwanda offering comprehensive Accounting, auditing services, tax and financial advisory with headquarter in Kigali, Rwanda and we operate in Rwanda, Uganda, India and Dubai.

Location

ALSM LTD (Formerly ALCPA)

KG 623 St, Kimihurura - Kigali, Rwanda

© 2025 ALSM Ltd (Formerly ALCPA). All rights reserved.