What is the Tourism Tax?

- Tax rate: 3%

- Tax base: Total accommodation amount (excluding VAT)

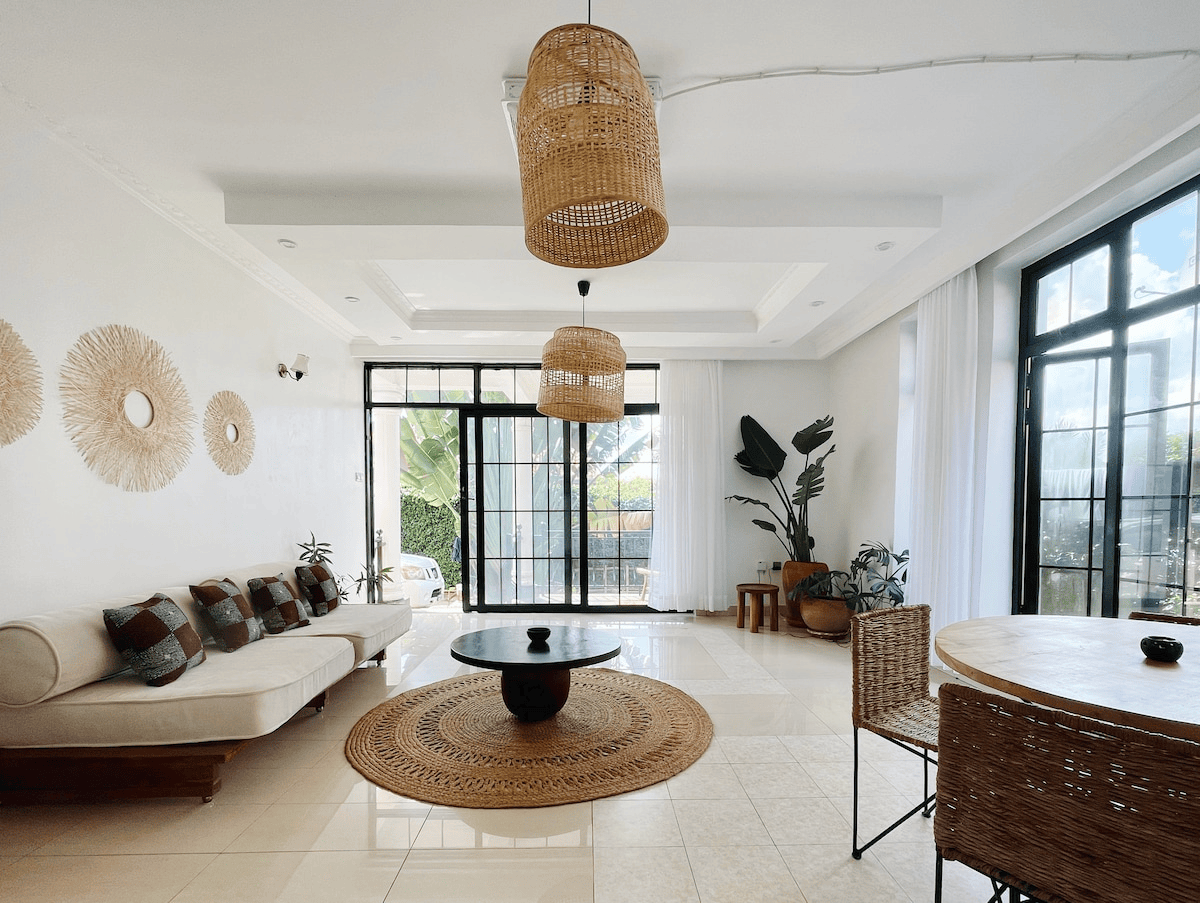

- Applies to: All hospitality service providers

Why Was the Tourism Tax Introduced?

Goals of the tax include:

- Expanding Rwanda’s tax base without overburdening SMEs

Supporting national tourism infrastructure and marketing initiatives

Enhancing data-driven tourism policy making through formalized records

What It Means for Hospitality Businesses

For operators in the hospitality space, this tax means:

Monthly reporting and filing requirements through the RRA E-Tax system

Need for clear record-keeping and digital billing systems

Increased accountability in pricing and invoicing

It also opens opportunities to formalize operations, access support programs, and build trust with international travel platforms and investors.

How ALSM Ltd Can Help

At ALSM Ltd, we understand the financial and operational pressure that new regulations can bring—especially to hospitality businesses that may not have in-house tax experts.

With a team of 55+ globally certified professionals (including CPA Rwanda, ACCA UK, and ICAI India), we provide:

Sunny MATETI

Managing Partner

Chartered Accountant and Certified Public Accountant, I excel in managing intricate tasks, adhering to strict deadlines, and providing outstanding results. My expertise is grounded in a solid 17+ years of experience in auditing, accounting, tax, and advisory services.

Stay Compliant. Stay Competitive.

Don’t let regulations slow down your hospitality business. ALSM Ltd is your trusted partner in Rwanda’s evolving tax landscape.