What Is an RDB Annual Return?

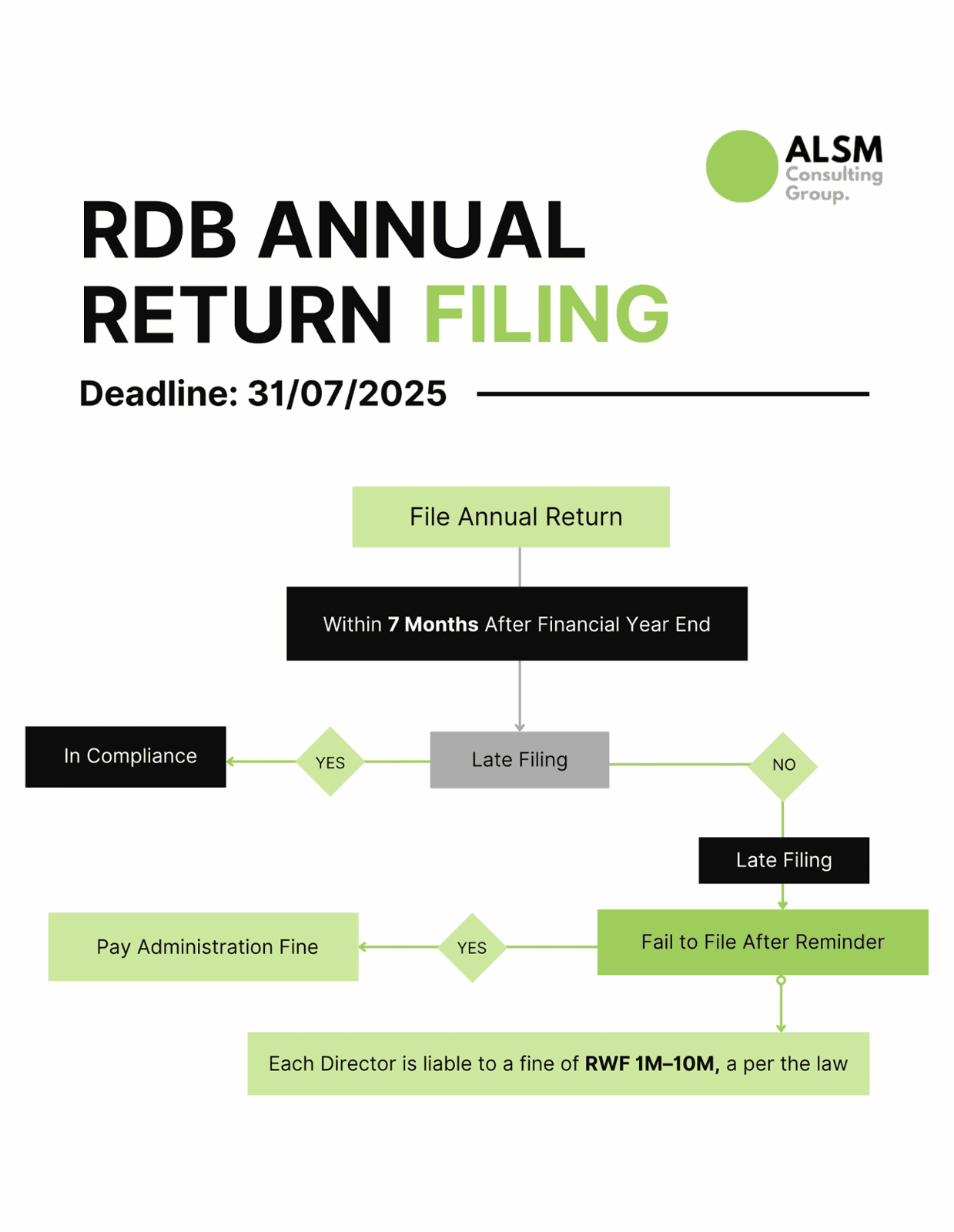

What Happens If You Miss the Deadline?

- Late filing results in administrative penalties.

- If the return is still not filed after reminders, each director may face fines between RWF 1 million and RWF 10 million.

- It can also affect your business registration status and public standing.

How ALSM Ltd Can Help

As one of the leading accounting and compliance firms in Kigali, ALSM Ltd offers full support to ensure you meet all RDB filing obligations—accurately and on time.

Sunny MATETI

Managing Partner

Chartered Accountant and Certified Public Accountant, I excel in managing intricate tasks, adhering to strict deadlines, and providing outstanding results. My expertise is grounded in a solid 17+ years of experience in auditing, accounting, tax, and advisory services.

Need Assistance?

Don’t wait until the deadline. Our experts are ready to assist you with your RDB Annual Return or Beneficial Ownership registration.