Blog categorized as Tax

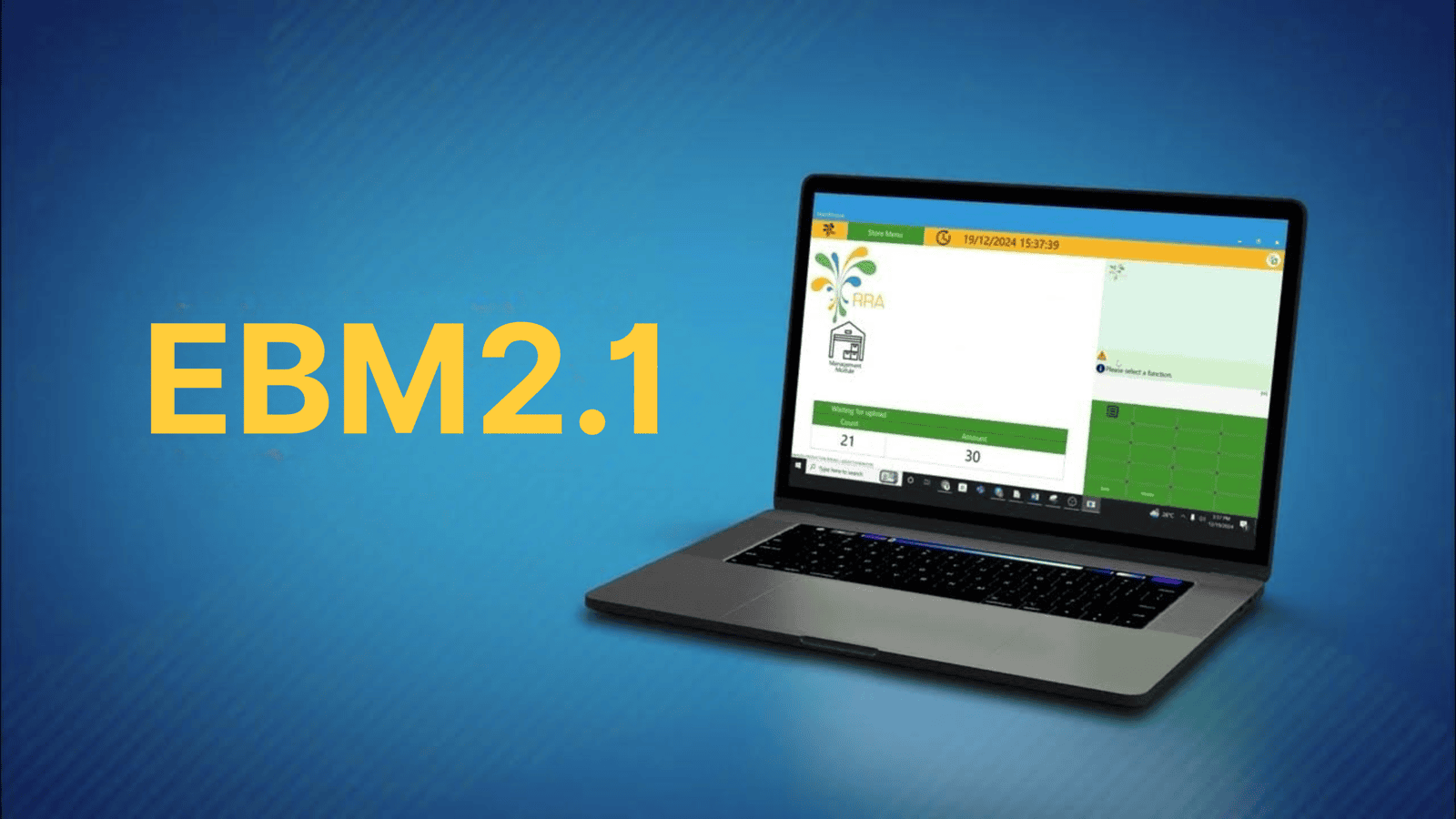

The Government of Rwanda introduced a 3% Tourism Tax on accommodation through Law nº 015/2025, effective May 29, 2025. If you run a hotel, guesthouse, lodge, or short-term rental (like Airbnb), you are now legally required to register and file this tax monthly via the RRA (Rwanda Revenue Authority...

Categories

- Uncategorized

(0)

- Tax

(7)

- Compliance

(1)